Prospective home buyers, especially new or younger home buyers, are hesitant to buy in this market after seeing mortgage rates push 8% in 2023. The 30-year rate (at the time of this writing) now sits at 7%-7.5%, the variance depending on multiple factors – with the most pertinent being credit and down payment amount.

You often hear “My parents refinanced a couple years ago at 2.75%!” Or “My best friend bought in 2021 at 3%! I can’t see myself paying 5% higher!”. It makes sense for buyers of the Millennial generation to think this way: the 30-year rate during the majority of any Millennial’s (classified as being born between 1981 and 1996) adult life has never averaged over 5% in any given year. In comparison, the newest adults entering the housing market – Gen Z’ers (born 1997 to 2012) – have never seen an interest rate much higher than 4%, with an average of 3.5%. During a Millennial’s formative years in the early 1990’s to mid-2000’s, rates dropped from 11% to an average of 6.5%. As they entered the workforce, they navigated the Great Recession and Housing Market crash. Activity by the Federal Reserve resulted in the rates dropping even more; the 2010’s averaged 3.72%. Then Covid hit, resulting in the Fed cutting the interest rate. This caused the 30-year rate to hit its aforementioned historic lows, and by January of 2021, their lowest mark ever: 2.65%.

With rates at these levels for what seems like forever, it must be the norm, right? I mean, the last time interest rates hit 7% was 20 years ago. So why then, will those same parents or friends who took advantage of low rates in recent years will also tell you they paid upwards of 10% when they bought their first house in the 1990’s?! Additionally, you might think someone who purchased a home in the 1980’s is telling you a fish story when they say the rates were 15% or higher. But it’s not hyperbole: the 1980’s rates averaged nearly 13%; and, after the OPEC Embargo of 1981, topped out at a whopping 18.63% (another historic number) in October of that year.

With all that being said, notice how the word “historic” keeps being used. A historic recession so bad they needed a superlative to describe it. A pandemic so historic it changed everything, including the way the market operated. In terms of the mortgage rate, it created a perceived “new normal” – that 3-5% is normal. Simply put, it’s not. The average 30-year rate from 1971 to the present, or about the last 50 years, is 7.74% (nearly a percentage point higher than today’s rate). THAT is “normal”, whatever that means (right!).

So, with so much fluctuation guaranteed in interest rates, especially in the current economy, I can offer you a couple nearly-bonafide constants that support my advice to go ahead and marry the house, date the rate.

-

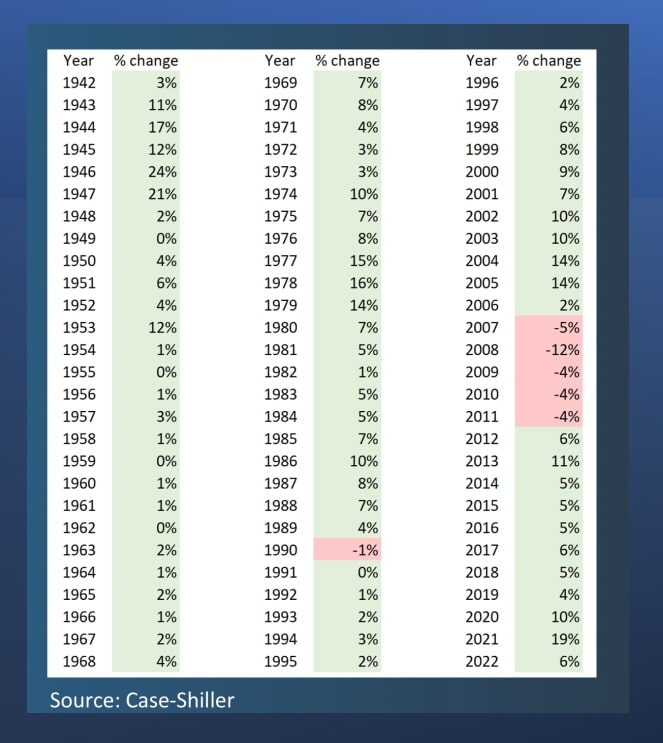

The value of homes has depreciated in exactly 6 years since the US entered World War II in late 1941:

Once during the early 90’s recession (by 1%); And in five consecutive years during the Great Recession from 2007-2011. Beyond that, home values have appreciated in 75 of the last 81 years, at an average of 4% per year.

-

Here I offer not a statistical constant, but rather an economic principle: when demand goes up, and especially when supply goes down in conjunction with a rise in demand, prices go up. Alternatively, when demand to buy in the housing market goes down (as what has happened when the interest rate went up), rent prices skyrocket. The average rent in Wisconsin went up over 10% as the interest rate went up. Choosing to rent becomes more costly in the current market. The average home price in Wisconsin in 2023 is about $285,000. The average rent is $1,700, or about $20,000 per year.

-

Why not just wait for the interest rate to go down? I mean that’s 10’s of thousands or more in compounding interest, that would save in the long run, right? I can’t answer that question definitively, but I can offer a historical example: In 1971, the interest rate was at about the same 30-year rate we have today. If you waited for rates to get under 7% consistently, you’d be waiting until 1998. In those 25+ years, the value of the home you would have bought in 1971 would be worth 5 times as much in 1998, not to mention all the money spent on rent.

Putting those three points together, along with the information about the 30-year rate above, we can come to the following conclusion: The average Wisconsinite “loses” $32,000 (20k for rent, 12k for appreciation of homes) per year by choosing to rent rather than buy. Meaning, money that could be going towards a mortgage payment and by simply owning the house. But that’s today. If the interest rate goes down, demand to buy will explode and home prices will follow – meaning the same home you wanted today will cost whatever the market forces settle on in 12 months, 2 years, etc. There is no definitive number for that, but I can tell you that when we had historic drops in the 30-year rate, homes went up by 50% in 4 years from 2019 to 2023 (rather than the 4% average). What about the inverse? Rates continue to go up, so home values will potentially drop, right? Wrong, history doesn’t suggest home values will go down.

Whew, that was a lot of numbers.

The moral of the story and all those numbers is this: waiting to buy because you are hoping for a lower rate isn’t historically a good proposition. Once you own that home, you’re free from potentially rising home prices (and the bidding wars that ultimately happen) when interest rates drop. While avoiding that, the home you bought will be worth more, because you know that your home is going to appreciate year over year. How much is really the question, not if; and you aren’t losing any equity to rent payments, which are going up exponentially in their own right. And guess what? When that annoyingly average/high-for-the-last-20-years 30-year rate does go down?

You can refinance and take advantage of the new rate, and still have reaped all the benefits of owning! So go ahead and put a ring on it – marry the house, date the rate.